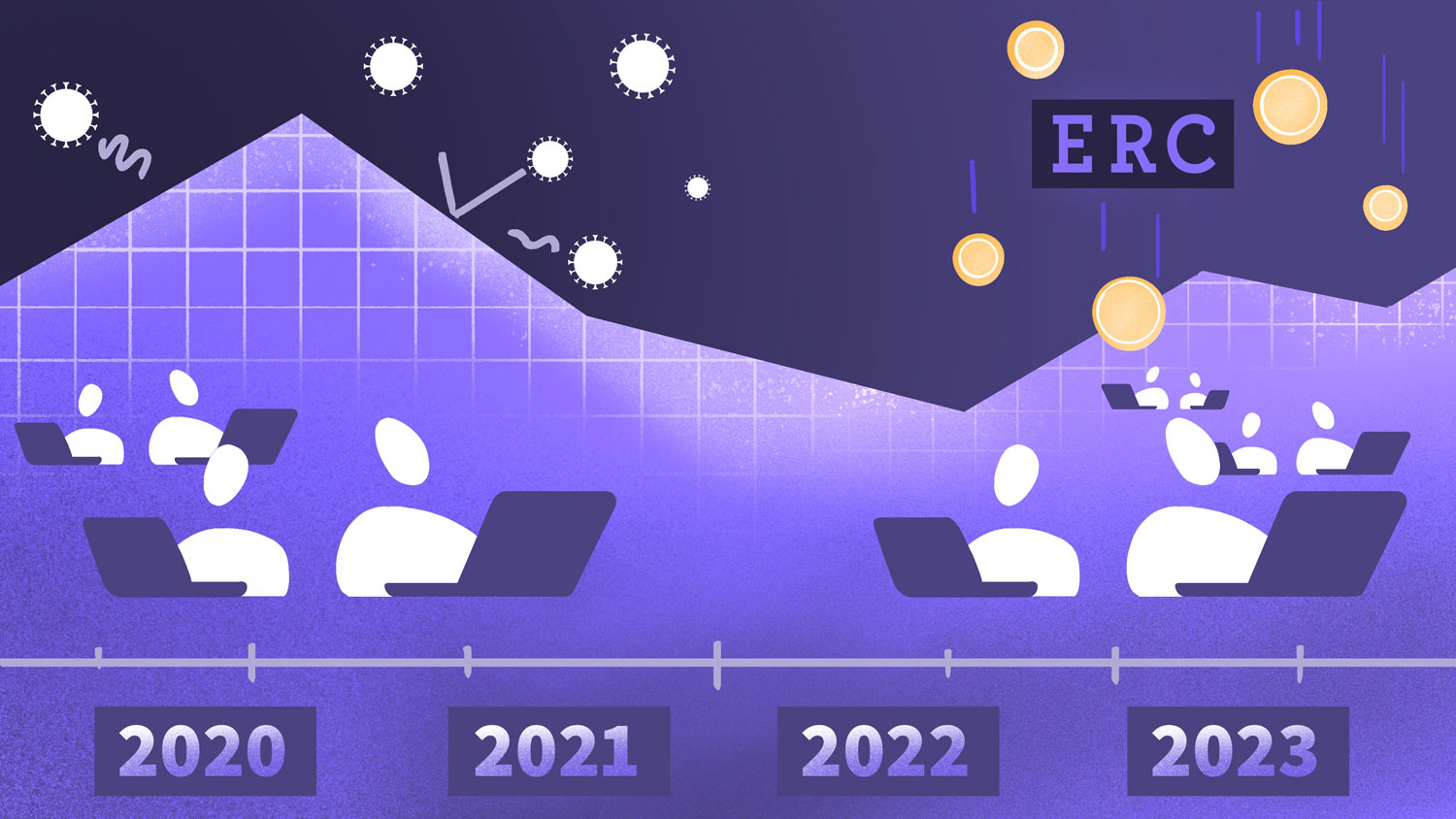

Answers to Your Employee Retention Credit (ERC) Questions

Are you a small business owner looking to understand and make use of the Employee Retention Tax Credit? Are you wondering how this credit works, if it applies to your business and what actions you need to take to receive it? Don’t worry—we have the answers.

With so much conflicting information about this important tax credit out there, we want to break down how it works and provide clear instructions on how business owners like yourself can apply.

Is the Employee Retention Credit still available?

Yes. The Employee Retention Credit (ERC) is still available, but only retroactively. Congress ended the ERC as of October 1, 2021, with the passage of the Infrastructure Investment and Jobs Act in November of 2021.

For the fourth quarter of 2021, the Employee Retention Tax Credit was only available to recovery startup businesses. A recovery startup business is one that:

- Started on or after February 15, 2020

- Has annual gross receipts of no more than $1 million

- Have one or more employees

To receive the Employee Retention Credit now, you must fill out Form 941-X to amend a previously filed quarterly employment tax return on wages paid from January 1, 2020, through October 1, 2021.

If your business qualifies for the credit, you have a three-year deadline from the date you initially filed Form 941 to file an amended form and receive a refundable tax credit.

Who is an eligible employer for the Employee Retention Credit?

For an employer to be considered eligible for the Employee Retention Credit, they must meet one of two criteria during the given calendar quarter:

-

A trade or business that had to entirely or partially shut down business operations or had to reduce hours of operation due to a government order.

or

-

A trade or business that experienced a significant decline in gross receipts.

The definition of a “significant decline in gross receipts” depends on the year for which you’re claiming the credit. For 2020 credits, gross receipts for the calendar quarter must be below 50% for the same quarter in 2019. For 2021 credits, gross receipts for the quarter must be more than 20% lower than the same calendar quarter in 2019.

New businesses can use the gross receipts for the quarter they started operations as a reference if they don’t have 2019 figures because they weren’t yet in business.

Is the Employee Retention Credit taxable?

The Employee Retention Credit is not taxable income, and you don’t need to pay any of it back, assuming you followed all the rules and regulations when claiming it.

However, the Employee Retention Tax Credit will impact your income tax return. Employer tax credits are applied by reducing your deduction for qualified wages in an amount equal to the credit received. It is important to properly report these post-credit earnings in the year they were received. So, for example, if the reduction applied to 2021, your 2021 tax return should reflect that reduction in employee wages.

How long does it take to get the Employee Retention Credit?

Initially, IRS guidance informed taxpayers they could expect to receive their refundable tax credit within six weeks to six months of filing Form 941-X. However, many business owners and tax professionals have reported much longer waits for Employee Retention Tax Credits–anywhere from nine to 12 months in some cases.

Larger employers–those anticipating refunds above $1 million– may take even longer because the IRS will subject these claims to an additional layer of scrutiny.

You can call the IRS at 800-829-4933 to check on the status of the refund, but you may have to wait on hold for quite a while to speak to a representative.

Can I get the Employee Retention Credit if I received a Paycheck Protection Program (PPP) loan?

Absolutely, you can qualify for the Employee Retention Credit even if you received a loan through the PPP.

However, you can only use the Employee Retention Tax Credit on wages that were not already used to calculate your PPP loan. So if you already received PPP loans on those wages, you can’t use them to claim the ERC.

I received the Employee Retention Credit, but I made a mistake in applying for it. Should I return the money?

Yes, you can return the money if you receive the Employee Retention Tax Credit and realize you did not qualify to claim it. First, you’ll need to file a new Form 941-X to correct the error. Then, you can repay the credit using the Electronic Federal Tax Payment System (EFTPS).

If you claimed the credit in error for multiple quarters, you need to file a separate Form 941-X and pay separately for each quarter.

If you need help determining eligibility for the Employee Retention Tax Credit or want to know more about how to navigate the rules and regulations, please contact us. We’re happy to help you make the most of this potentially valuable tax credit.